bexar county tax assessor payment

After logging in to your portfolio you can add more. The deadline each year is May 15th or 30 days after the notice is mailed whichever is later.

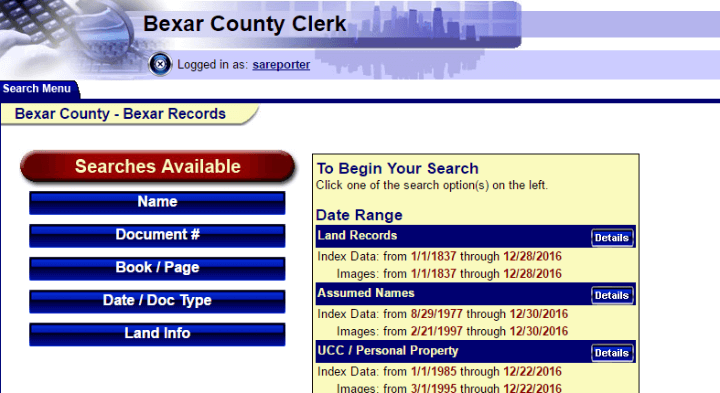

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

Search Bexar County Records Online - Results In Minutes.

. Bexar County Payment Locations. You can search for any account whose property taxes are collected by the Bexar County Tax Office. You may contact one of the following e-filing providers to electronically file documents with our office.

As a property owner your most important right is your right to protest your assessed value. In order to be timely payment mailing or common carrier of taxes must be postmarked or receipted on or before the due date of January 31st. Such as participating grocery stores.

Due to a change in the statue participating jurisdictions may elect to turn over their delinquent business. Clicking on the link below will take you to to a webpage with specific information and instructions for making that type of payment through our convenient and secure online network. The 10-Month Payment Plan applies to a property the person occupies as a residential homestead with one of the following exemptions.

Please follow the instructions below. After locating the account you can pay online by credit card or eCheck. Bexar County Tax Office.

100 Dolorosa San Antonio TX 78205 Phone. Of each tax year without penalty or interest. Bexar County Directory.

Downtown - 233 N. Mailed in October for. Each portfolio may consist of one or more properties and includes pertinent tax information such as property location certified owner and current year and total amounts due.

Box 839950 San Antonio TX 78283-3950. Northwest - 8407 Bandera Rd. Depending on start date.

100 Dolorosa San Antonio TX 78205 Phone. Thank you for visiting the Bexar County ePayment Network. Please contact your county tax office or visit their Web site to find the.

Enter an account number owners name last name first address. After locating the account you can pay online by credit card or eCheck. You can search for any account whose property taxes are collected by the Bexar County Tax Office.

The Online Portal is also available. Ad Submit Your County Of Bexar Payment Online with doxo. You can create a portfolio if you want to group multiple tax accounts together for easier review and payment.

There are several options available to taxpayers including Half Pay and Pre-Payment Plans. Bexar County Tax Assessor-Collector Office P. County tax assessor-collector offices provide most vehicle title and registration services including.

Disabled person exemption Age 65 or Over exemption. Pecos La Trinidad. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at 2103356628.

The district appraises property according to the Texas Property Tax Code and the Uniform Standards of. Commissioners Court Broadcast Agendas. Property taxes must be current Equal payments are due.

City of San Antonio Property Taxes are billed and collected by the Bexar County Tax Assessor-Collectors Office. Please select the type of payment you are interested in making from the options below. After locating the account you can also register to receive certified statements by e-mail.

Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. Offered by County of Bexar Texas. Ad Find Bexar County Online Property Taxes Info From 2022.

2022 and prior year appraisal data current as of Aug 5. A statement bill will be. Other locations may be available.

For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers. San Antonio TX 78205. Property Tax Payment Options.

Job Opportunities with Bexar County. The Bexar County Tax Assessor-Collectors Office is the only County in the State of Texas with a 10-month payment plan. The Pre-Payment Plan allows Homeowners and Business Owners without a mortgage escrow account to pre-pay their taxes in monthly installments through September 15.

This service includes filing an exemption on your residential homestead property submitting a Notice of Protest and receiving important notices and other information online. The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically. Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details.

Acceptable forms of payment vary by county.

Everything You Need To Know About Bexar County Property Tax

15 000 Homeowners In Bexar County Eligible For Help On Delinquent Property Taxes Kens5 Com

Bexar County Tax Assessor Registration Services 233 N Pecos St San Antonio Tx Phone Number Yelp

Everything You Need To Know About Bexar County Property Tax

Property Tax Information Bexar County Tx Official Website

Bexar County S Homestead Exemption To Cut 15 Off Property Tax Bill

Bexar County Tax Assessor Collector Taxes In North West San Antonio Parkbench

Payments Bexar County Tx Official Website

Property Tax Information Bexar County Tx Official Website

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Bexar County Considers 2 8b Budget Raises For Employees Officials

Showlist Bexar County Good Customer Service Acting

County Commissioners Vote To Decrease Property Tax Rate In 2022

Bexar County Budget Proposal Keeps Current Tax Rate

Bexar County Property Tax Deadline Looming Tpr

Public Service Announcement Residential Homestead Exemption

Nelda Martinez On Twitter Bexar County San Antonio Tx Corpus Christi

Chief Appraiser Expects A New Record Of Appeals To Be Filed Next Week In Bexar County